Are you ready to jump into the world of cryptocurrency and potentially become a millionaire? With the right knowledge and strategy, you can turn your investment into substantial profits. In this blog post, we will explore the key steps to becoming a successful crypto investor. From understanding the basics of cryptocurrency to mastering the art of investing and building a diversified portfolio, we will cover it all. We will also discuss the importance of following trends, staying informed, and taking calculated risks to make profitable trades. By the end of this post, you will have the essential skills and knowledge to navigate the crypto market with confidence and work towards achieving your financial goals. Whether you’re a beginner looking to get started or an experienced investor wanting to up your game, this guide will provide valuable insights to help you on your journey to becoming a crypto millionaire.

Understanding the Basics of Cryptocurrency

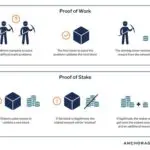

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates on a decentralized network. It is not controlled by any central authority, such as a government or a bank, which makes it immune to government interference or manipulation. This form of currency relies on blockchain technology, which is a distributed ledger that records all transactions across a network of computers.

One of the key features of cryptocurrency is its security. Transactions made with cryptocurrency are secure and private, thanks to the use of cryptographic techniques. The use of public and private keys ensures that only the sender and receiver can access the funds. This level of security is one of the main reasons why cryptocurrency has gained popularity among individuals and businesses.

Another important aspect of cryptocurrency is its volatility. The value of cryptoassets can fluctuate significantly within a short period of time, which poses both opportunities and risks for investors. This volatility is driven by factors such as market demand, technological developments, and regulatory news. Understanding the risks associated with cryptocurrency is crucial for anyone considering investing in this market.

Overall, understanding the basics of cryptocurrency is essential for anyone looking to participate in this innovative financial system. From its decentralized nature to its security features and market dynamics, cryptocurrency presents a new paradigm for money and finance. As the cryptomarket continues to evolve, individuals and businesses need to educate themselves about this emerging asset class.

Mastering the Art of Investing in Cryptocurrency

Investing in cryptocurrency can be a daunting task for beginners, but with the right knowledge and strategy, it can also be a profitable endeavor.

Before diving into the world of cryptocurrency investment, it’s important to understand the basics. This includes familiarizing yourself with different types of digital currencies, such as Bitcoin, Ethereum, and Litecoin, as well as learning about blockchain technology and how it impacts the market.

Once you have a solid understanding of the fundamentals, you can start mastering the art of investing in cryptocurrency. This involves creating a diversified portfolio, staying informed about market trends, and taking calculated risks to make profitable trades.

Building a strong foundation of knowledge and staying updated on the latest developments in the cryptocurrency market is essential for mastering the art of investing. It’s also important to approach cryptocurrency investment with caution and patience, as the market can be volatile and unpredictable.

Building a Diversified Crypto Portfolio

When it comes to investing in cryptocurrency, it’s important to build a diversified portfolio in order to spread out the risks and maximize potential returns. Building a diversified portfolio means investing in a variety of different crypto assets, rather than putting all your eggs in one basket. This approach can help protect your investments from the volatility often associated with cryptocurrencies.

One way to build a diversified crypto portfolio is to invest in different types of cryptocurrencies, including established coins like Bitcoin and Ethereum, as well as up-and-coming altcoins. By investing in a mix of different crypto assets, you can reduce the risk of being heavily impacted by the performance of any single cryptocurrency.

Another strategy for building a diversified crypto portfolio is to consider investing in a variety of sectors within the cryptocurrency market. For example, you might invest in DeFi (Decentralized Finance) projects, NFTs (Non-Fungible Tokens), and privacy-focused cryptocurrencies. This approach can help you take advantage of different trends and opportunities within the crypto space.

Ultimately, building a diversified crypto portfolio requires careful research and strategic decision-making. By spreading your investments across different cryptocurrencies and sectors, you can position yourself to weather market fluctuations and potentially benefit from the growth of the crypto market as a whole.

Following the Trends and Staying Informed

Staying informed about the latest trends in the cryptocurrency market is crucial for any investor or trader. Keeping up with the news and developments in the industry can help you make well-informed decisions and stay ahead of the game.

One way to follow the trends is to regularly check reputable crypto news websites and forums. These sources often provide valuable insights into the current market situation and upcoming developments in the industry.

Another effective way to stay informed is to follow influential crypto influencers on social media platforms. These individuals often share their thoughts and analysis on the latest trends, which can offer valuable insights for your investment strategy.

Additionally, joining crypto communities and discussion groups can provide you with a platform to exchange ideas and learn from others in the industry. Engaging in conversations with like-minded individuals can help you gain a deeper understanding of the market dynamics and emerging opportunities.

Taking Calculated Risks and Making Profitable Trades

When it comes to investing in cryptocurrency, taking calculated risks and making profitable trades is essential. In the volatile world of digital assets, it’s important to have a strategy in place to minimize potential losses and maximize gains.

One way to take calculated risks is to carefully research and analyze the market trends. By staying informed about the latest developments in the crypto space, investors can make more informed decisions and avoid impulsive trades that could lead to losses.

Additionally, it’s important to diversify your crypto portfolio to spread the risk across multiple assets. This can help mitigate potential losses if one particular cryptocurrency experiences a significant downturn.

Finally, making profitable trades requires patience and discipline. It’s important to set clear goals and boundaries, knowing when to enter and exit the market to lock in gains and minimize losses.

Frequently Asked Questions

What is cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security and operates independently of a central bank.

How can I start investing in cryptocurrency?

You can start by opening an account on a cryptocurrency exchange, researching different cryptocurrencies, and making informed investment decisions based on your risk tolerance and financial goals.

Why is it important to diversify your crypto portfolio?

Diversifying your crypto portfolio helps spread your investment risk and can potentially increase your chances of making a profit in the long run.

How can I stay informed about cryptocurrency trends?

You can stay informed by following reputable cryptocurrency news sources, joining online communities and forums, and regularly checking the performance of your crypto investments.

What are some important factors to consider before making a crypto trade?

Before making a trade, consider factors such as market trends, trading volume, price fluctuations, and potential regulatory developments that could impact the cryptocurrency market.

What are the risks associated with investing in cryptocurrency?

Some risks include price volatility, security threats, potential regulatory changes, and the possibility of losing your investment. It’s important to carefully consider these risks before investing.

What are some tips for making profitable crypto trades?

Some tips include setting clear investment goals, conducting thorough research, using risk management strategies, and staying disciplined in your trading approach.