The world of cryptocurrency has seen a meteoric rise in recent years, giving birth to a new generation of billionaires. These individuals have amassed immense wealth in a relatively short amount of time, but with this newfound prosperity comes unforeseen challenges and tragedies. In this blog post, we’ll explore the captivating rise of crypto billionaires, as well as the tragic loss experienced within this unique community. We’ll dive into the causes of the untimely deaths of some of these billionaires and the valuable lessons learned in protecting their assets. Additionally, we’ll examine the future of crypto billionaires and what measures can be taken to ensure their survival and continued success in this rapidly evolving industry. Join us as we delve into the complex world of crypto billionaires and the unique challenges they face.

The Rise of Crypto Billionaires

In recent years, the world has witnessed an unprecedented rise in the number of crypto billionaires. These individuals have accumulated vast wealth through their investments in various cryptocurrencies such as Bitcoin, Ethereum, and others. The surge in the value of these digital assets has led to the creation of a new class of ultra-rich individuals who have made their fortunes in the volatile and sometimes controversial world of cryptocurrency.

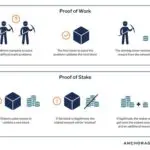

The rise of crypto billionaires can be attributed to the increasing popularity and acceptance of digital currencies as a legitimate form of investment. As more people have become aware of the potential returns associated with cryptocurrency trading, the number of investors in this space has grown exponentially. This has allowed early adopters and seasoned traders to amass substantial wealth as the value of cryptocurrencies has soared to new heights.

Furthermore, the decentralization and anonymity of cryptocurrencies have provided individuals with an alternative means of accumulating wealth outside of traditional financial systems. This has been particularly appealing to those who are skeptical of centralized banking institutions and government-controlled currencies. As a result, a new breed of entrepreneurs and investors have emerged, leveraging crypto assets to build their own fortunes.

The rise of crypto billionaires has also been fueled by the technological innovations and advancements within the cryptocurrency space. The development of blockchain technology and the proliferation of new altcoins have created a fertile ground for wealth accumulation and investment opportunities. As a result, many individuals have been able to capitalize on the dynamic nature of the crypto market to amass significant wealth.

Tragic Loss: The Death of Crypto Billionaires

The crypto world was rocked by tragedy this week as two crypto billionaires met their untimely demise in separate incidents. The first was a fatal car accident involving a well-known crypto investor who had recently made headlines for his risky investment strategies. The second was a mysterious suicide of a prominent crypto entrepreneur who had been facing intense scrutiny and legal battles. The sudden loss of these two influential figures has left the crypto community in mourning and has raised serious questions about the pressures and dangers of being a crypto billionaire.

Both individuals were known for their significant contributions to the crypto industry and had amassed considerable wealth through their investments and innovations. Their deaths have sent shockwaves through the crypto market and have highlighted the unique challenges and risks that crypto billionaires face. In the wake of these tragedies, the crypto community is grappling with the sobering realities of the crypto world, and many are calling for greater support and protection for crypto billionaires who are vulnerable to the pressures of their high-stakes lifestyle.

As the crypto community mourns the loss of these two influential figures, there is a renewed emphasis on the need for mental health support and the importance of seeking help in times of crisis. The deaths of these crypto billionaires serve as a sobering reminder of the human cost of the crypto world, and the need for greater awareness and intervention to prevent further tragedies from occurring.

Despite the somber mood that has gripped the crypto community, there is also a sense of determination to honor the legacies of these two crypto billionaires and to continue their work in advancing the crypto industry. Their deaths have sparked important conversations about the unique challenges and risks that crypto billionaires face, and there is hope that their tragic loss will ultimately lead to greater awareness and support for the mental and emotional well-being of those within the crypto community.

Exploring the Causes of Crypto Billionaire Deaths

The world of cryptocurrency has seen an unprecedented rise in wealth, with many individuals becoming crypto billionaires seemingly overnight. However, with this rise in wealth comes an increased risk of danger, as evidenced by the tragic deaths of several prominent crypto billionaires. These deaths have raised questions about the safety and security of these individuals, and it is crucial to explore the causes behind these untimely demises.

One of the primary causes of crypto billionaire deaths is the lack of regulation and oversight in the cryptocurrency industry. Many crypto billionaires operate in a largely unregulated environment, making them vulnerable to a range of risks, including theft, extortion, and violence. Without the protection of traditional banking and financial institutions, crypto billionaires are left to navigate a complex and often dangerous landscape on their own.

Additionally, the anonymous nature of cryptocurrency transactions makes it difficult to track and recover stolen funds, further increasing the risk for crypto billionaires. This lack of transparency and accountability creates an environment in which individuals can exploit and target crypto billionaires with little fear of consequences.

Furthermore, the volatile nature of cryptocurrency markets can also contribute to the deaths of crypto billionaires. The sudden and dramatic fluctuations in the value of cryptocurrency can lead to significant financial losses, placing immense pressure and stress on crypto billionaires and potentially driving them to desperate measures.

Lessons Learned: Protecting Crypto Billionaires’ Assets

As the number of crypto billionaires continues to grow, the need for effective asset protection has become increasingly important. The volatile nature of the crypto market presents unique challenges in safeguarding these individuals’ wealth. From hacking and fraud to market crashes, crypto billionaires face an array of threats to their assets.

One of the most important lessons learned in protecting crypto billionaires‘ assets is the need for robust cybersecurity measures. With cyberattacks becoming more sophisticated and prevalent, it is essential for these individuals to invest in state-of-the-art security systems to protect their digital assets. This includes employing top-notch encryption, multi-factor authentication, and regular security audits to ensure that their crypto holdings are secure from potential breaches.

Another key lesson is the importance of diversifying assets beyond crypto investments. While the potential for high returns in the crypto market is appealing, it also carries significant risk. Crypto billionaires should consider diversifying their wealth into traditional assets such as real estate, stocks, and bonds to mitigate the impact of market downturns and volatility in the crypto space.

Furthermore, seeking professional financial and legal advice is crucial for crypto billionaires in order to establish effective estate planning and asset protection strategies. This includes creating trust structures, wills, and establishing offshore accounts to safeguard their wealth. By working with experienced experts in the field, crypto billionaires can ensure that their assets are shielded from potential threats and properly managed for future generations.

The Future of Crypto Billionaires: Surviving and Thriving

As the world of cryptocurrency continues to evolve and grow, so does the number of crypto billionaires who have amassed great wealth through their investments. However, with great wealth comes great responsibility, and crypto billionaires must be prepared to navigate the challenges and risks that come with their newfound fortune.

One of the key factors in surviving and thriving as a crypto billionaire is ensuring the security of their assets. With the rise of cyber attacks and hacking attempts targeting crypto billionaires, it is essential for them to invest in top-notch security measures to safeguard their wealth. This may include hiring cybersecurity experts, utilizing secure wallets, and staying updated on the latest security protocols.

In addition to security, crypto billionaires must also focus on diversifying their investment portfolio to ensure long-term success. While cryptocurrency has proven to be a lucrative investment, it is important for crypto billionaires to explore other investment opportunities to mitigate risk and protect their wealth. This may include traditional stocks, real estate, and other assets that can provide stability and growth.

Furthermore, crypto billionaires should prioritize giving back to the community and contributing to philanthropic efforts. By using their wealth to make a positive impact on the world, crypto billionaires can build a legacy that transcends their financial success and ensures their lasting influence.

Frequently Asked Questions

What is the rise of crypto billionaires?

The rise of crypto billionaires refers to the increasing number of individuals who have amassed significant wealth through their investments in cryptocurrencies.

How many crypto billionaires have died?

There have been several reported cases of crypto billionaires passing away, but the exact number is not publicly available.

What are the causes of crypto billionaire deaths?

The causes of crypto billionaire deaths can vary, and may include accidents, health issues, or other unforeseen circumstances.

What lessons can be learned from the deaths of crypto billionaires?

It is important for crypto billionaires to take steps to protect their assets, including creating a comprehensive estate plan and implementing security measures for their digital assets.

What does the future hold for crypto billionaires?

The future of crypto billionaires involves finding ways to safeguard their wealth and ensure its continued growth in the ever-changing landscape of cryptocurrency.