In recent years, the world of cryptocurrency has become a hot topic of discussion in the financial world. However, for those who adhere to Islamic principles, the question of whether cryptocurrency is halal or haram is a pressing issue. In this blog post, we will delve into the complex relationship between cryptocurrency and Islamic finance, exploring the principles of Islamic finance and how they apply to the world of digital currencies. We will also discuss the opinions of Islamic scholars on the matter, as well as the efforts to determine which elements of cryptocurrencies are halal and which are haram. Additionally, we will explore the emergence of Sharia-compliant cryptocurrencies as an alternative for Muslims, and the potential impacts of cryptocurrency on Islamic banking and finance. Join us as we navigate the intersection of cryptocurrency and Islamic finance to determine whether crypto is halal.

Understanding the Principles of Islamic Finance

Islamic finance is a system of financial activities that comply with sharia law. It is based on principles such as fairness, transparency, and risk-sharing. One of the key principles of Islamic finance is the prohibition of riba (usury or interest). This means that earning interest on loans is strictly forbidden. Instead, Islamic finance promotes profit-sharing and operates on the concept of mudarabah (profit-sharing partnership).

Another principle of Islamic finance is the avoidance of gharar (excessive uncertainty or risk). This means that all financial transactions must be clearly defined and free from ambiguity. Additionally, Islamic finance is based on the concept of halal (permissible) and haram (forbidden). This means that all financial activities and investments must comply with sharia law and ethical guidelines.

Furthermore, Islamic finance encourages the use of zakat (almsgiving) as a means of redistributing wealth and supporting the less fortunate. Zakat is a mandatory charitable contribution that is obligatory for all financially-able Muslims. It plays a crucial role in promoting social justice and reducing inequality within Islamic finance.

Overall, understanding the principles of Islamic finance is essential for anyone interested in participating in halal financial activities. By adhering to these principles, individuals and institutions can ensure that their financial dealings are in line with sharia law and ethical standards.

Islamic Scholars’ Opinions on Crypto

Islamic scholars have varying opinions on the use of cryptocurrencies within the framework of Islamic finance. Some scholars argue that cryptocurrencies are speculative in nature and carry a high degree of uncertainty, which is prohibited in Islamic finance. They believe that the absence of tangible assets backing cryptocurrencies makes them akin to gambling, which is forbidden in Islam. These scholars view the volatility and unpredictability of crypto markets as incompatible with the principles of Islamic finance.

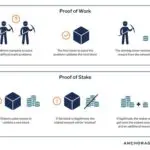

On the other hand, some Islamic scholars are open to the idea of cryptocurrencies, considering them as a form of digital money that can be used for legitimate transactions. They argue that the underlying technology of cryptocurrencies, known as blockchain, has the potential to revolutionize the financial system and bring about greater transparency and efficiency. These scholars believe that if cryptocurrencies are used in ethical and socially responsible ways, they can be in line with Islamic principles.

Another perspective put forth by Islamic scholars is the importance of distinguishing between different types of cryptocurrencies. They emphasize the need to assess each cryptocurrency on a case-by-case basis to determine whether it complies with Islamic law. This involves examining the nature of the digital asset, the purpose of its use, and the mechanisms governing its issuance and circulation.

Overall, the opinions of Islamic scholars on cryptocurrencies reflect a diversity of viewpoints, ranging from outright prohibition to conditional acceptance. The debate surrounding the compatibility of cryptocurrencies with Islamic finance continues to evolve as the digital asset landscape grows and matures.

Determining Halal and Haram Elements in Cryptocurrencies

When it comes to investing in cryptocurrencies, one of the biggest concerns for Muslim investors is whether these digital assets are Halal or Haram according to Islamic law. There are a number of factors that need to be considered in order to determine the religious permissibility of investing in cryptocurrencies.

First and foremost, it’s important to consider the source of the funds used to invest in cryptocurrencies. If the money used to invest comes from Halal sources such as legitimate business profits, then the investment in cryptocurrencies can be considered Halal. On the other hand, if the money comes from Haram sources such as interest-bearing loans or illegal activities, then the investment would be considered Haram.

Another important factor to consider is the nature of the cryptocurrency itself. For a cryptocurrency to be considered Halal, it must not be involved in activities that are prohibited in Islam, such as gambling, speculation, or financing unethical businesses. In addition, the cryptocurrency should not be linked to any interest-bearing financial activities.

Ultimately, determining whether a cryptocurrency is Halal or Haram requires a thorough understanding of Islamic finance principles and a careful evaluation of the specific cryptocurrency in question. It’s important for Muslims to consult with knowledgeable scholars and experts in Islamic finance to ensure that their investments comply with the teachings of Islam.

Sharia-Compliant Cryptocurrencies: An Alternative for Muslims

With the rise of digital currencies, the debate about their compatibility with Islamic finance principles has been ongoing. Many Muslim investors have been looking for Sharia-compliant cryptocurrencies as an alternative to traditional financial instruments. The concept of cryptocurrency being Sharia-compliant is a complex issue that requires an in-depth understanding of Islamic finance principles.

One of the main concerns regarding traditional cryptocurrencies such as Bitcoin is the lack of transparency and the potential for speculation, which are considered haram (forbidden) in Islamic finance. However, some newer cryptocurrencies have been designed with Sharia-compliant features, such as built-in zakat payments and compliance with Islamic contract principles.

For Muslim investors, the availability of Sharia-compliant cryptocurrencies offers a new avenue for participating in the digital economy without compromising their religious beliefs. These Sharia-compliant digital assets are designed to adhere to the ethical and legal standards set by Islamic law, providing a viable alternative for those who wish to embrace the benefits of cryptocurrency while upholding their faith.

Furthermore, the emergence of Sharia-compliant cryptocurrencies has sparked discussions within the Islamic finance community about the potential for integrating digital assets into traditional financial frameworks. As technology continues to reshape the global financial landscape, it becomes increasingly important for Islamic financial institutions to explore innovative solutions that cater to the evolving needs of Muslim investors.

Impacts of Cryptocurrency on Islamic Banking and Finance

In recent years, the rise of cryptocurrency has had a significant impact on the world of Islamic banking and finance. As this new form of digital currency continues to gain traction, many in the Islamic finance community are grappling with the potential implications and challenges it presents. One of the key concerns is determining whether cryptocurrency is Sharia-compliant, meaning it adheres to the principles of Islamic law.

Furthermore, the increased popularity of cryptocurrency has led to a need for Islamic scholars to weigh in on the matter. Their opinions on whether cryptocurrency aligns with Islamic principles of finance and banking carry significant weight within the community. The question of whether cryptocurrency is halal or haram is a complex one, and it requires a deep understanding of both Islamic finance principles and the intricacies of cryptocurrency technology.

Another important aspect to consider is the potential for cryptocurrency to serve as an alternative within the Islamic banking and finance sector. As more and more Muslims become interested in cryptocurrency, there is a growing demand for Sharia-compliant cryptocurrencies as an option for investment and transactions. This has the potential to reshape the landscape of Islamic banking and finance, as traditional financial institutions may need to adapt to accommodate this new form of digital asset.

Overall, the impacts of cryptocurrency on Islamic banking and finance are far-reaching and multifaceted. From determining its Sharia-compliance to considering it as an alternative within the industry, there are various implications to consider. As the world of cryptocurrency continues to evolve, so too will its effects on Islamic banking and finance.

Frequently Asked Questions

What are the principles of Islamic Finance?

Islamic finance follows the principles of Sharia law, including the prohibition of usury (riba), speculation (gharar), and unethical or haram investments.

What are Islamic scholars’ opinions on crypto?

Opinions vary among Islamic scholars, but some consider cryptocurrency as permissible as long as it complies with Islamic principles and does not involve haram elements.

How do we determine halal and haram elements in cryptocurrencies?

Halal elements in cryptocurrencies may include transparency, ethical mining, and compliance with Islamic finance principles. Conversely, haram elements may involve speculation, interest-based transactions, or investment in haram industries.

Are there Sharia-compliant cryptocurrencies available?

Yes, there are efforts to develop Sharia-compliant cryptocurrencies that adhere to Islamic finance principles, offering an alternative for Muslim investors.

What impacts do cryptocurrencies have on Islamic banking and finance?

Cryptocurrencies pose challenges and opportunities for Islamic banking and finance, as they may offer new investment avenues while also raising concerns about compliance with Sharia law and financial regulations.