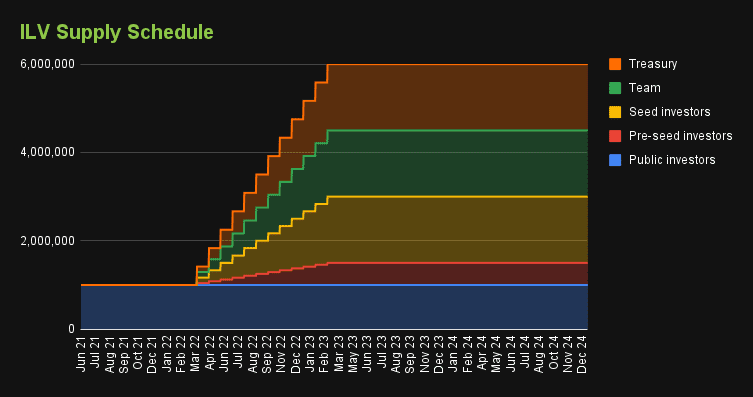

Vesting, in the cryptocurrency markets, refers to the gradual release of tokens distributed to a project’s founders, investors, and other key stakeholders over a specific period. Vesting aims to ensure the long-term sustainability of the project and prevent token holders from selling their tokens immediately. What is Vesting?

What is Vesting?

It is a commonly used practice in cryptocurrency markets. For instance, a project’s founders may release a portion of their tokens through vesting based on the success of the project. This encourages founders to demonstrate long-term commitment to the project and prevents a rapid influx of tokens into the market.

Investors may also receive tokens through vesting. For example, a project might distribute a portion of its tokens through vesting to attract investors. This prevents investors from immediately selling their tokens and helps maintain the project’s liquidity.

The Importance of Vesting When Buying and Selling

Vesting is a crucial factor to consider when trading in cryptocurrency markets. It helps stabilize token prices by preventing a rapid release of tokens into the market.

Considerations for vesting in trading include:

- Vesting Period: Tokens with longer vesting periods can prevent a significant number of tokens from entering the market quickly, contributing to price stability.

- Vesting Ratio: Tokens with higher vesting ratios ensure a consistent release of tokens into the market, reducing price fluctuations.

Vesting serves as an important tool to mitigate risks for investors in cryptocurrency markets. By considering vesting while trading, investors can make more informed decisions.