If the prospect of purchasing a home has crossed your mind, you may find yourself contemplating the current mortgage rates in the UK.

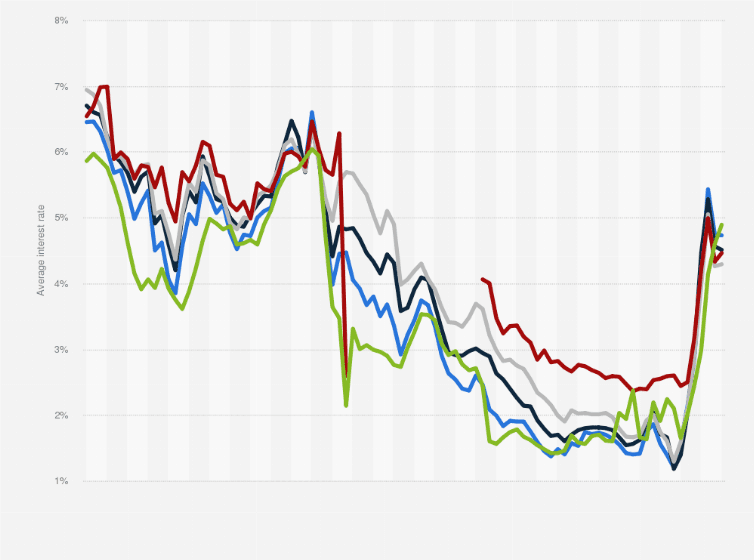

The landscape of mortgage rates is one that undergoes frequent alterations, with lenders routinely adjusting the rates of their mortgage products. In light of this dynamic environment, we diligently update the average mortgage rates on a weekly basis. This allows for a comprehensive understanding of the shifts in rates, enabling you to compare them to the previous week’s metrics. Furthermore, our updates encompass a spectrum of loan-to-value (LTV) percentages, providing you with a nuanced perspective on the diverse range of rates available.

What’s the latest on mortgage and interest rates?

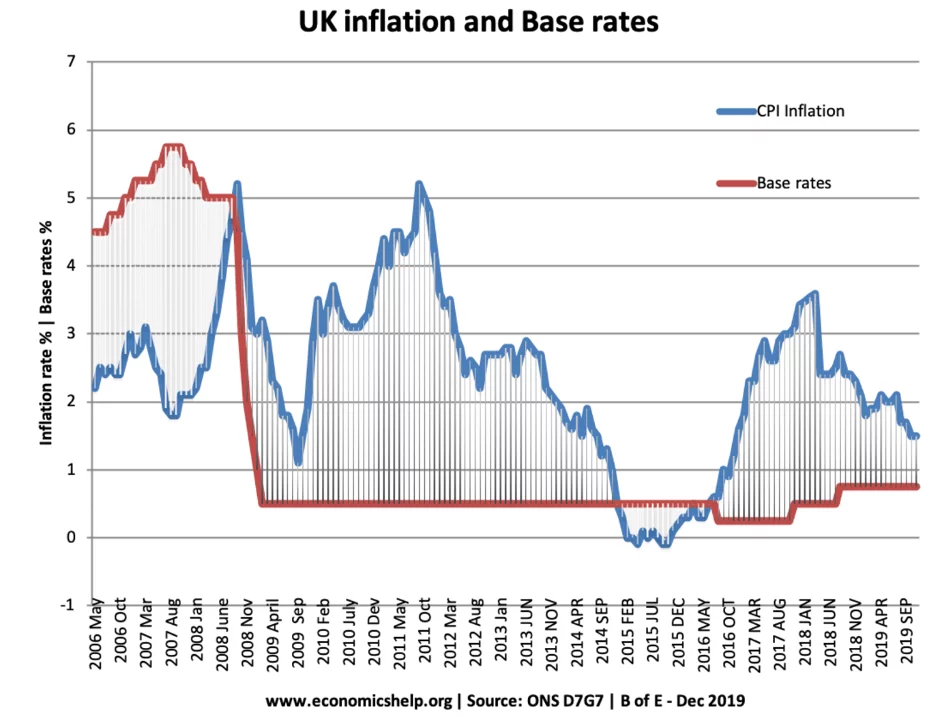

Current discussions are buzzing with updates on Base Rate fluctuations and their potential impact on mortgage rates. The Bank of England (BoE) convenes approximately every six weeks to deliberate on whether the Base Rate should rise, fall, or remain unchanged. As of now, the Base Rate stands at 5.25%, maintaining this level since August.

Insights from our mortgage expert, Matt Smith, shed light on the ongoing trends: “Rate cuts have gained momentum in the past week, witnessing declines across various loan-to-value categories. There is a noticeable effort from lenders to attract individuals with smaller deposits, as evidenced by the most substantial weekly reduction of 0.17% in the 95% loan-to-value bracket.

“In recent weeks, we observed the most economical rates dipping below 5% for individuals with larger deposits. The eagerly anticipated sub-5% rate has now materialized for the 90% LTV bracket, a segment where many first-time buyers often find themselves.”

As of now, the average mortgage rate for a five-year fixed, 85% loan-to-value mortgage stands at 5.29%, marking a decline from last week’s 5.35%. Notably, the lowest rate for this mortgage type currently stands at an enticing 4.77%.

When might we anticipate a decline in mortgage rates?

At present, the financial markets are indicating that the Base Rate could be at its zenith. The prevailing belief is that interest rates will remain relatively stable throughout much of 2024 before commencing a descent. Projections suggest that fixed-rate mortgage products will gradually integrate some of these reductions.

Recent weeks have witnessed a gradual easing of mortgage rates in response to favorable inflation figures. However, pinpointing the onset of more substantial declines remains challenging, primarily due to the dependency of mortgage rate movements on various factors. These include the sustained decrease in inflation, declining swap rates, and the absence of unforeseen economic shocks.

Exploring the implications of this week’s average mortgage rates on average monthly repayments, especially in comparison to rates offered last week, is a natural curiosity. For a first-time buyer considering the current average asking price of £223,426 for a typical property, the average monthly mortgage payment, based on an average five-year fixed, 85% loan-to-value mortgage with a 25-year repayment period, is now £1,143 per month. This marks a decrease from £1,178 a year ago.

The determination of the mortgage amount you can secure hinges on an affordability assessment, while your interest rate is influenced by your deposit’s size, known as loan-to-value (LTV). LTV, expressed as a percentage, represents the mortgage size relative to the home’s value. A higher deposit corresponds to a lower LTV, and vice versa.

Utilizing a mortgage calculator provides a practical means to estimate your borrowing capacity. For a more personalized insight, obtaining a Mortgage in Principle takes you a step closer to securing a mortgage offer.